Have we finally reached a conclusion in the US Steel-Nippon Steel saga?

For the moment, yes, but we'll see how the deal's parameters impact the state of play over the coming months / years.

Before we get started on today’s main event, here is an interesting bit of polling dug up by Substacker Jay Kuo.

This first poll, taken in the days before the US bombed Iran, found there was a bipartisan consensus that America should not get involved.

Just 15% of Democrats and 23% of Republicans thought the US military should enter the Israel/Iran conflict.

Below is polling conducted in the two-days after the US bombed Iran’s nuclear sites. The percentage of Democrats and Independents who approved / disapproved of Trump’s decision didn’t change by much. But Republican support did a complete 180, going from 23% up to 68%!

Talk about party loyalty.

And just how successful were these attacks at destroying Iran’s nuclear capabilities? As The New York Times reported yesterday, preliminary reports suggest not very successful…(PTO emphasis added)

A preliminary classified U.S. report says the American bombing of Iran’s nuclear sites sealed off the entrances to two of the facilities but did not collapse their underground buildings, according to officials familiar with the findings.

The early findings conclude that the strikes over the weekend set back Iran’s nuclear program by only a few months, the officials said.

Before the attack, U.S. intelligence agencies had said that if Iran tried to rush to making a bomb, it would take about three months. After the U.S. bombing run and days of attacks by the Israeli Air Force, the report by the Defense Intelligence Agency estimated that the program was delayed less than six months.

[…]

The report also said much of Iran’s stockpile of enriched uranium was moved before the strikes, which destroyed little of the nuclear material. Some of that may have been moved to secret nuclear sites maintained by Iran.

Trump and Rubio downplayed this report produced by the US Defense Intelligence Agency, and Israeli officials claim the attacks “severely damaged the nuclear program, and pushed it back years.”

Again, it’s early days, and know one truly knows the extent of the damage. But the immediate bombast about how the attacks completely “obliterated” Iran’s nuclear capacity really should be modulated, and expectations should be tempered.

Below is a quick update on one of our favorite stories from the past year, Nippon Steel’s pursuit of US Steel.

As the US’s position in the global manufacturing ecosystem has fallen over the past century, the prospects of US Steel have correspondingly declined.

But could Nippon Steel, one of the largest steelmakers in the world, be a source of regeneration and hope for this former titan of American industry? You will recall last year the Japanese conglomerate Nippon Steel spent months haggling with the Biden administration over the firm’s proposed acquisition of the one-time American manufacturing giant.

Indeed despite US Steel’s fading relevance, the deal became a political flashpoint. After the deal was announced in December 2023, both Biden (and Harris) and Trump denounced the deal, ostensibly over national security concerns, claiming US Steel was first and foremost a US company and that any ownership handover would be detrimental to US interests, even if new ownership was a key American ally and the chief East Asian bulwark against China.

More importantly, despite Nippon’s promise to inject much needed investment into the local US market to keep American operations humming along, the steelworkers union opposed the deal. The union was a key constituency in Pennsylvania, one of the critical states in the 2024 race for the White House. As a result, no politician was going to stick their necks out and support the deal, in fear of being denounced as an opponent of the American working class.

But with the election over, the new White House could sit with both companies at the negotiating table, free from the prison of party politics, and come to an arrangement. And earlier this month, amidst everything else going on, Trump approved Nippon Steel’s bid to purchase US Steel. Justifying the move, the White House said any potential national security risks (the previous excuse for opposing the deal) could be mitigated through a national security agreement brokered between Nippon Steel, US Steel and the US government.

The steelworkers union is not too enthusiastic about the deal, saying they are “disappointed” in Trump’s decision and worried about what happens when the union’s labor agreement expires in September 2026, which could play into the midterms a few weeks alter.

But Nippon Steel upped the ante a bit, sweetening the pot to make the deal even more attractive. After originally pledging to invest $2.7bn back in January, Nippon Steel agreed to increase its overall US investment by more than 4x to $14bn through 2028 (including $3bn for a new steel mill). This is a substantial increase from US Steel’s own investment last year of just $2.3bn. When combined with the headline purchase price ($14.9bn), the total outlay by Nippon Steel comes to nearly $30bn.

While the politics are not as consequential now as they were in 2024, appearances still matter. The public statements from the companies around the deal have referred to this as a ‘partnership’ between Nippon Steel and US Steel rather than the true terms of the deal: Nippon Steel acquiring 100% of US Steel shares.

But Nippon Steel also provided the administration with something that could be more consequential than an increase in investment.

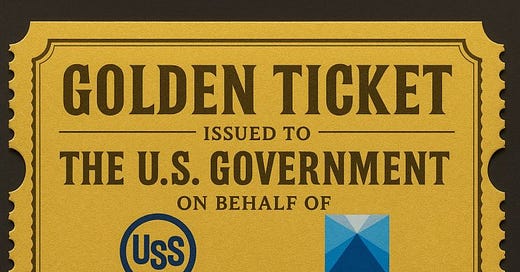

The golden share

Nippon Steel gave the US government a perpetual ‘golden share.’ This golden share grants the Trump administration (and future presidential administrations) an assortment of rights including,

The power to name one of the corporate board’s three independent directors (and approve / reject candidates for the other two positions), and

Consent rights regarding a myriad of business decisions in the US.

While the exact details of the golden share remain vague, including how it will function, Trump’s commerce secretary, Howard Lutnick, extolled the deal’s virtues on Twitter/X, claiming “the perpetual Golden Share” gives the government the power to block actions including,

Relocating US Steel’s HQ away from Pittsburgh,

Adjusting Nippon Steel’s $14bn of agreed-upon near-term investments into US Steel,

Changing its sourcing of raw materials, and

Transferring production / jobs out of the US.

As Lutnick notes, the deal will “expand steel production in the United States…[and] massively [expand] access to domestically produced steel.”

A slippery slope?

While the US government will not have economic equity in the company (so it can’t directly profit from the company), it does give the government some operational control and the ability to override decision-making in the name of national security. The idea of ceding control to the government has some dealmakers spooked over whether this is the new normal for multinational corporations looking to invest in the US during the Trump era.

Also, how will this impact trade negotiations between Washington and Tokyo? If the parties are able to reach an agreement that saves Japan from Trump’s tariff regime, or makes the terms less onerous, that could also indicate a path forward. But is it one sovereign nations really want to take? Offering the US government the ability to dictate terms on cross-border deals?

A lot depends on how the golden share is implemented over the coming months / years. If the administration appears to take a more hands-on approach, that could further cow investment. But if the White House is more circumspect and gives Nippon Steel a long leash, foreign investors may feel the structure of this deal was more of a one-time event than anything.