News at the top: Last week Joni Ernst, the Republican Senator from Iowa, hosted a town hall. Her constituents came worried about the proposed cuts to Medicaid included in the House’s budget reconciliation and asked Ernst what she is going to do to protect them.

She starts by talking about how the bill focuses on “corrections” to remove people who are not entitled to Medicaid. But as the attendees start shouting at Ernst, saying she is telling lies and that people will die as a result, Ernst flippantly comments “well, we all are going to die” and smiles.

Over the weekend Ernst ‘apologized’, if you can call this video she posted to Instagram an apology. “So I apologize. And I’m really, really glad that I did not have to bring up the subject of the Tooth Fairy as well.”

Is there any wonder why the public hates politicians and thinks they are in it just for themselves?

Summary

Green circle = indicator has moved in a positive direction

Red circle = indicator has moved in a negative direction

MoM change = month-over-month change

Financial markets

Post-Election Day performance

The below chart tracks financial indicator performance in 2025. Values at December 31, 2024 have been rebased to 100 for comparison-sake.

Source: Author’s calculation

S&P 500

After the market chaos that was April, a bit of sunshine broke through in May, with the S&P (up 6%) having its best monthly performance since November 2023. But with tariffs continuing to swing in and out of the picture whether this can be sustained is an open question.

An interesting point of note to consider. While the stock market is not the real economy, more Americans are invested in the stock market right now than at any point post-Global Financial Crisis.

The psychological wealth effect that comes from buoyant markets (or conversely, sagging valuations) is real and will be something to watch over the summer.

2025 Year-to-date return: 0.51%

Post-election return: 2.23%

Source: Marketwatch

**************************

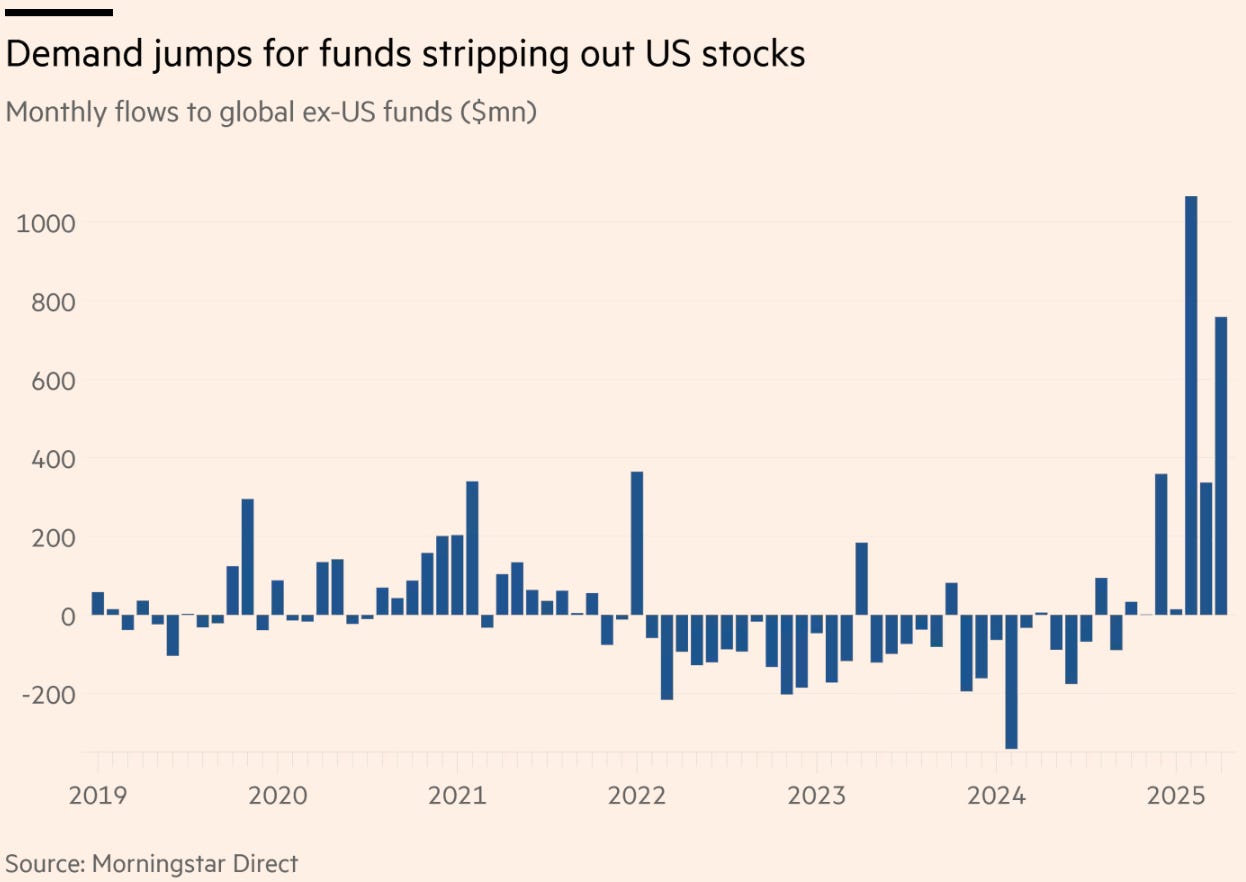

Something else to watch: investors are pilling record sums into global equity funds that exclude US stocks. This is a stark difference from 2022-2024 when investors were consistently pulling money out of these types of funds and seeking more exposure to the ebullient US market.

Bitcoin

There has been a lot of ink spilled over the Trump family’s increasingly close ties to crypto, and the way foreign influencers can discreetly provide crypto in exchange for influence. Most recently, Trump Media announced it would raise $2.5bn to invest in Bitcoin and JD Vance spoke at a bitcoin conference in Vegas last week.

The Department of Labor also rescinded Biden-era guidance that discouraged retirement funds from investing in cryptocurrencies and more public companies are starting to invest in Bitcoin.

The upshot? Bitcoin had a good month.

Keep reading with a 7-day free trial

Subscribe to Nuance Matters to keep reading this post and get 7 days of free access to the full post archives.